Many people save funds in standard accounts like savings accounts. But not all saving methods provide true asset control.

Let’s explore which savings vehicles give you real wealth control, and why it’s important for building long-term financial success.

1. Owning Stocks for Direct Company Equity

When you invest in stocks, you own a part of a company. This grants you ownership and allows you to benefit from dividends and market growth.

While stocks carry risk, balancing your assets helps reduce exposure and increase long-term returns.

2. Real Estate: Tangible Asset Ownership

Real estate offers a physical asset that grows in value. Buying rental homes lets you generate monthly cash flow.

You can also use leverage to expand your holdings and multiply returns over time.

3. Start a Business to Create Ownership

Owning a business puts you in control of your income and financial decisions. It’s harder work than stocks, but can yield massive rewards.

Scaling operations increases your business value — a powerful form of ownership.

4. Bonds vs. Equities: Know the Difference

Bonds are debt instruments to governments or corporations — they read more don’t offer ownership. Stocks, on the other hand, grant you equity.

Knowing this helps you choose between safety and growth potential.

5. Diversified Ownership via Funds

Mutual funds and ETFs allow you to invest in many companies indirectly. You don’t control individual businesses, but you benefit from diversification.

These are popular for those who want passive investing.

6. Gold and Silver as a Store of Wealth

Owning gold, silver, or platinum gives you a hedge against inflation. These metals don’t lose worth like paper money and can be liquidated easily.

They offer long-term strength to your wealth-building plan.

7. copyright as a Modern Form of Ownership

copyright like Bitcoin offers digital wealth. These assets can gain massively, though they carry higher risk.

Always research carefully before investing in copyright.

8. Retirement Accounts: Ownership with Tax Perks

Retirement accounts allow you to own a mix of assets while enjoying tax advantages. Contributions often go into stocks, bonds, or funds.

Over time, these accounts build both future wealth and retirement freedom.

9. Collectibles and Rare Assets

Assets like classic cars can grow in value and represent unique forms of ownership. They’re less conventional, but often valuable if chosen wisely.

This path suits those with patience in niche markets.

Final Thoughts

Choosing true asset-building paths is the key to growing wealth. Whether you invest in copyright or run a business, holding value builds lasting financial power.

Always invest smart, and let your savings become your legacy.

Neve Campbell Then & Now!

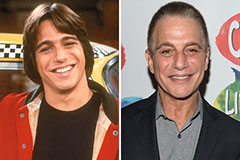

Neve Campbell Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!